3 Major Credit Bureaus

There are 3 major credit bureaus; Equifax, Transunion, and Experian. Creditors are not required to report to all three credit bureaus. Therefore, your score may vary under each credit bureau.The average difference in scores between the highest and lowest of your credit scores, from the three bureaus is 60 points. This is the result of the credit bureaus having different items on their report, which may be correct, incorrect, or are not reported in full compliance with credit law. Each credit bureau is a for-profit organization and they collect information on how you manage your credit.

Credit Bureaus make money by providing the following services:

Credit Bureaus make money by providing the following services:

- Selling your credit information

- Charging creditors to report information on your credit reports

- Charging creditors and you to review your credit report

- Charging to obtain credit scores

- They also charge more for challenged credit reports

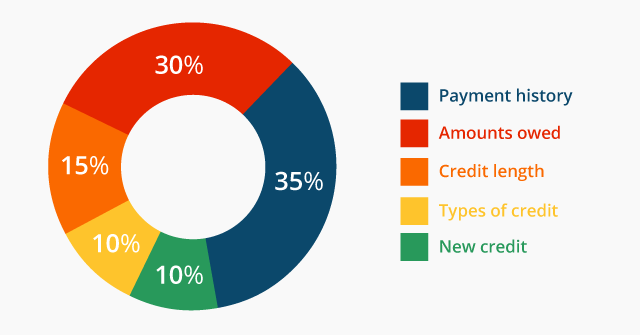

How is my credit score calculated?

How can you help our team help you achieve the best results?

Building your credit is a mutual effort. Our team will work diligently to ensure you have results and meet your credit goals. However, it is imperative that you make your payments on time for any accounts with a balance. Late payments can drastically effect your credit score and ultimately defeat our results. Also, it is not recommended to open any new credit accounts until we have completed working on your credit file. Try to maintain your credit to debt ratio below 30%, if possible under 10% for maximum results. Communication is a vital component of restoring and building your credit. If you receive any communications from creditors or credit bureaus during our submissions, please provide our team a copy.